As a majority of developed nations aim to decarbonize and become more sustainable, regulations will be a driving force behind this transition.

Current Regulatory Landscape

Regulations aimed at defining sustainable activities and products and providing transparency in the market to prevent greenwashing are already enacted in multiple countries. The US Securities and Exchange Commission (SEC) recognizes the need of regulations to both meet their 2050 net zero goal and to ensure investors and consumers are adequately informed on Environmental, Social, and Governance (ESG) claims.

Key SEC Rules

The SEC has proposed two rules and amended the fund Names Rule as a way to meet the aforementioned goals:

1. ESG Strategy Rule (ESG Disclosures for Investment Advisers and Investment Companies)

2. Climate-Related Disclosures Rule (Enhancement and Standardization of Climate-related Disclosures)

Details of the Names Rule

The update to the Names Rule was adopted in September of 2023 and is currently an active regulation. The amendments to the Names Rule were recommended to prevent deceptive labeling of funds and prevent greenwashing. It provides investors with basic information on the types of investments that are to be made by the fund and holds fund managers accountable. The rule applies mostly to public funds, with private funds being exempt. The amendments adopt an 80% strategy which requires 80% of the investments in the fund to align with the name of the fund. For example, a fund that mentions decarbonization in its name would require 80% of investments to be made with the goal of decarbonization, such investments could include climate tech and renewable energy assets.

It is recommended fund managers review their portfolios quarterly or more, and if found to be out of compliance, get back into compliance within 90 days. The rule does not have requirements established for the percentage not needed to align with the name. This means a fund aimed at decarbonization could use the other 20% of the fund to invest in fossil fuels. This may lead to deceptive investment practices.

Overview of the ESG Strategy Rule

The ESG Strategy Rule was proposed to both provide transparency on the level of ESG integration in a funds strategy and help provide standardized ESG reporting to investors. The scope extends mostly to public investment companies and registered advisors, again, leaving out private funds. Due to the delay in ruling, there is not an estimated timeline for when the Rule would become effective. The Rule outlines three fund labels which are dependent on the level of ESG integration. The three labels are Integration, ESG-focused, and Impact. Each requires disclosures in the fund’s prospectus and for ESG-focused and Impact funds, additional annual disclosures are required.

Integration Funds are funds that consider ESG, but their consideration does not carry greater weight than non-ESG factors. Disclosures are limited to what ESG factors are considered and how they are considered by the investment team. In the summary of the prospectus, an overview of these disclosures must be provided. Later in the document, a more detailed description of how factors are considered must be disclosed. If GHG emissions are considered, the methodology and data sources must also be described.

For ESG-focused funds, ESG factors are the main consideration of the investment strategy. Factors could include GHG emissions, adherence to human rights standards, and worker health and safety. A summary and more detailed description of how these ESG factors are taken into account must be disclosed in the prospectus of the fund. Additionally, fund managers must report annually on how the fund carried out the strategy, including proxy voting results on ESG-related topics, engagement practices, and if environmental factors are considered as part of the strategy, GHG emissions and carbon intensity must also be reported.

Impact funds are the most ambitious of fund types as they seek to achieve a certain environmental or social objective. Prospectus disclosures must include the impact the fund aims to achieve, the time in which it is to be achieved, how progress will be measured, and the relationship between the impact and financial returns. The annual report must provide progress updates on the objective. Fund managers must report on how the fund is achieving its impact, such as through proxy voting and other engagement practices, progress on the goal through qualitative and quantitative data, and if the fund has an environmental objective, GHG emissions and carbon intensity must also be disclosed. If there are material factors that may impact the fund’s ability to achieve their objective, those must also be described in the annual report.

While the status of the rule is unknown, fund managers should still be transparent when integrating ESG into their investment strategy to avoid greenwashing. Firms that are found not carrying out their disclosed ESG strategy are subject to large fines, as seen with Deutsche Bank who was fined $19m for violations. Regulations like the ESG Strategy Rule help to provide investors with the information needed to invest in funds and channel capital to low carbon and sustainable assets.

Climate-Related Disclosures Rule

The final ESG-related rule released by the SEC applies to corporations. The Climate-related Disclosures Rule requires companies to evaluate how climate risks may impact the company financially. This information can be used by investors to determine the viability of a business given the increase in climate risks worldwide. Being an SEC proposed rule, the scope is limited to publicly listed companies and excludes private companies. While the rule was initially passed in March of 2024, litigation has tied its implementation up in court. Criticisms came from both sides with some feeling implementation is too costly and time consuming and others stating the Rule did not go far enough to understand climate risks and provide meaningful data.

The Rule leverages the TCFD framework (Task Force on Climate-related Financial Disclosures) and the Greenhouse Gas Protocol and provides guidance on how to assess the impact of a changing climate and how to calculate a carbon footprint and other carbon metrics. Companies in scope must conduct an assessment that identifies material climate-related risks and opportunities and transition risks that may impact the company’s bottom line. An example of this would be a manufacturing company whose process relies heavily on water but is operating in locations subject to prolonged periods of drought, which may impact some facilities from operating at full capacity.

As part of the reporting under the Rule, which must be done annually as part of a company’s annual financial report, the company must disclose the identified material impacts, the impact these risks have on a company’s strategy, including the use of carbon offsets and RECs. The process for identifying and managing any risks must also be described, including information on a transition plan and scenarios used. The oversight and management within the organization must be described which aims to ensure there is proper oversight on this topic. Importantly, the company must calculate the financial impact of the climate-related risks and opportunities. This allows companies to understand how their business’s ability to operate and grow may change given different climate scenarios and timeframes.

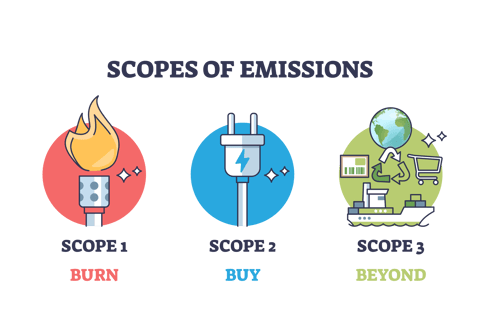

The draft rule required companies to disclose their scope 1, 2, and 3 emissions, but the final rule omitted scope 3 requirements and limited scope 1 and 2 due to the number of comments in opposition, largely due to the resources needed to calculate emissions. If a company has targets in place, they must also describe the scope of activities and/or emissions included in the targets, along with the time horizon to achieve them and any intermediary targets. This rule will be an important step for companies to adapt and mitigate to climate risks so that they can be viable and more sustainable in the future.

Conclusion

As the global push towards sustainability intensifies, regulations like those proposed by the SEC are essential in steering both corporations and investment funds towards genuine ESG commitments. While challenges remain, particularly in the United States, due to political polarization and ongoing litigation, these regulations represent a critical step in ensuring transparency and accountability. By aligning financial strategies with environmental goals, these measures not only safeguard investors from greenwashing but also empower them to contribute to a sustainable future. As the world leans towards a low-carbon economy, it is imperative that the US strengthens its regulatory stance to align with international standards, thereby fulfilling its net-zero commitments and maintaining its role in the global economic landscape.